Multiple Time Frame Analysis: Maximize Your Profits Today

Effective Forex trading requires careful analysis and consideration of various factors. One crucial aspect that traders should prioritize is multiple time frame analysis.

Multiple time frame analysis is a dynamic approach that enhances the precision of trade entries and exits, offering a comprehensive view of market trends and movements.

Before we begin, thanks for visiting Trading Strategy Guides (TSG)! We are so glad you’ve found us. You have discovered the most extensive library of trading content on the internet. Our aim is to provide the best educational content to traders of all stages. In other words, we want to make YOU a consistent and profitable trader.

If you’re a brand new trader, we recommend hopping over to our ultimate beginner’s guide to trading to learn more.

By examining different time frames before entering a trade, traders can gain valuable insights and make more informed decisions. In this article, we will explore the significance of multiple time frame analysis and how it can enhance trading strategies.

Keep reading to learn more!

Table of Contents

Introduction to Multiple Time Frame Analysis

Multiple time frame analysis is one of the most important things you can do before you take any trade.

To help you remember this analogy, consider this true story. It explains what multi-time frame trading is and why you should use it on every trade you take.

Suppose you live in an area where there can be bad weather for a few days in a row. In that case, you understand the importance of knowing what the weather will be like if you plan on doing anything outside, especially if you live in areas with a potential for tornadoes, hail storms, snowstorms, hurricanes, and so on.

So, let me explain a few essential lessons (as traders) we can learn by simply scanning the weather radar.

In the meantime, feel free to check out our guide to Forex trading for beginners.

Lessons That Traders Can Learn from the Weather Radar

This may sound silly, but trust me, this is some good stuff. The other day, I was planning an outside activity that required there to be no rain, no snow, no excessive winds, etc… You get the point.

It needed to be nice and sunny out at this time (4 p.m.).

Well…

Here is what the radar would have looked like earlier in the day before the special event I was planning at 8 a.m.

So at 8 a.m., it was looking like a beautiful day. The birds were chirping; the sun was out, and there was a light breeze. Overall, perfect.

However, remember, 4 p.m. was 8 hours away at this point.

I then zoomed out of the weather radar to see if there was any inclement weather heading in my direction, and I will be at my location at 4 p.m.

As you may expect, here is what I found:

Snow/rainstorms were heading in quickly. This horrible weather would arrive at my exact location roughly around the time of my planned activity!

Long story short, I ended up rescheduling my event due to the inclement weather that was going to take place.

Make sure also to check out our simple day trading Forex strategy.

To tie this example into our trading habits, if I had not “zoomed out” at a larger frame and seen what was taking place a few hundred miles away, I would have been devastated when the time came for my event. There were 6 inches of snow on the ground.

This exact scenario can be compared to multi-timeframe analysis. As traders, we do on our charts every time we trade.

The Importance of Multiple Time Frame Analysis

Never get caught in just taking trades in one timeframe. Think of it like you are the Forex multiple time frame indicator. You are the indicator that scans different time frames.

What multiple time frame analysis is simply this:

If you trade on a 5-minute chart, you should have your eyes on 30-minute and 1-hour time charts. Now, if you trade on a 15-minute chart, you should be checking out the 1-hour and 4-hour charts, etc.

Here’s an example:

You see a move like the above on a 5-minute chart, and you think, “Wow, I need to get in the short trade.”

However, what you have not done is “zoom out” and check other larger time frames that may be showing something “very” different.

As you see below on a larger 1-hour time chart, this may have been a simple retracement before returning to a bullish trend.

That is why checking other time frames every time you want to make a trade is important.

Most of the time, you will learn a significant amount of information if you bump up to a larger time frame or bump down to a shorter one. Look for prior support, resistance, a trending pair, or one that is in a current channel.

Here are some of the main advantages of using this type of approach before you enter a trade:

Benefits of Multiple Time Frame Analysis

- Key levels of support and resistance may exist near your trade, but that can’t be seen in the time frame you are trading on.

- The trend may appear differently in the time frame you are looking at than where the long-term trend is moving.

- Price may appear to have room to move on the one-time frame where it is actually quite over-extended on a lesser time frame.

- You can make a much more precise entry point on shorter times than on longer ones.

- You may take a great trade on a short time frame and hit your target but not realize you could have let it run for a way bigger profit due to the longer-term trend.

Multiple Time Frame Analysis Using TOFTEM

Multiple time frame analysis offers traders the variety needed to implement the TOFTEM model. Before we embark on this journey, let us explain what degrees of time frames we use and what TOFTEM stands for.

Trading Strategy Guides uses five primary time frames. Irrespective of the time frame a trader chooses, it’s best to maximize the number of time frames to five. For this article, we will use the following:

- Weekly

- Daily

- 4 hour

- 1 hour

- 15 min

Note: Some traders use the 8-hour and/or 2-hour charts instead of the daily, 4-hour, and/or 1 hour. This is perfectly fine.

TOFTEM stands for:

- Trend

- Opportunity

- Filters

- Trigger

- Entry Method

See below to see what each one of the TOFTEM terms means:

Step 1: Trend

- The recommended trend time frames are the 4-hour, 8-hour, and/or daily charts because they provide a sufficient overview of the past price action in the market. Traders can adequately judge whether a market is trending, reversing, or ranging.

- If a trader trades long-term positions, then the weekly chart is optimal.

- If a trader trades very short-term positions, then a 1-hour or 2-hour could be better.

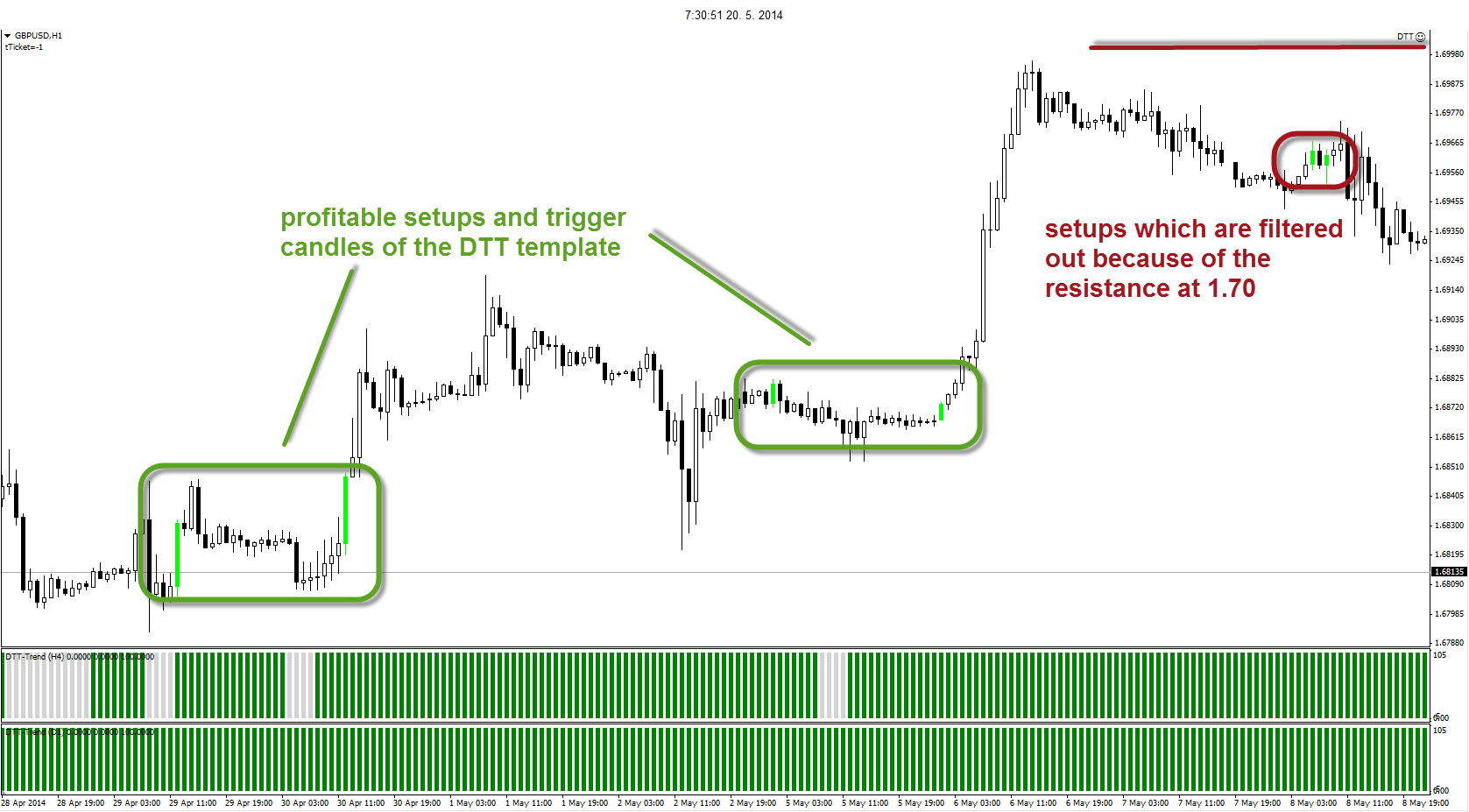

The beauty of our DTT trend indicators is that they automatically show what the trend is in the 4-hour and daily charts, no matter what timeframe you are looking at! This keeps your trading simple and consistent throughout time. Here, you can see a funny video about trading levels.

Suppose the market matches what your strategy is looking for. In that case, you can move on to the next step, which is an opportunity. If not, then move on to the next currency pair.

Step 2: Opportunity

Trading Strategy Guides recommends checking whether there is an opportunity for one and/or 2-time frames lower than the trend chart. This allows traders to zoom in and look for trade setups in the direction of their step 1.

Step 3: Filters

We recommend checking whether there is a filter on 1 (and/or two times) frame(s) higher than the trend chart. This allows traders to check whether any major support or resistance levels (and/or other chart elements) could block multiple time-frame trading systems from materializing.

The currency pairs that remain interesting after review via these three steps can be placed on a “watch list.” These are trade setups that are getting close to execution.

Step 4: Trigger

Now that the potential trade setup is close, Trading Strategy Guides recommends checking for triggers on the 2 (and/or three times) frame(s) lower than the trend chart. The trigger chart should be closer to price action than the trend in Step 1 (Trend) and Step 2 (Opportunity) as it keeps in sync with the market rhythm.

Step 5: Entry Method

The timeframe for entry can actually be quite diverse. It can be the same as the trigger chart, or even again, the 1-time frame is lower. Also, it could be the same time frame as the Step 2 Opportunity chart.

Let’s talk about some of your options and how each style can benefit from multiple time frame analysis:

Day Trading

Day traders can benefit from multiple time frame analysis in the following ways:

- Improved trade selection: Analyzing higher time frames helps identify the overall market trend, allowing day traders to focus on trades aligned with the prevailing direction.

- Enhanced entry and exit timing: By considering lower time frames, day traders can pinpoint optimal entry and exit points within the broader trend, increasing the likelihood of capturing profitable price movements.

- Confirmation of trade signals: Checking multiple time frames provides confirmation of trade setups, reducing the risk of false signals and increasing confidence in executing trades.

- Effective risk management: Examining higher time frames helps determine key support and resistance levels, allowing day traders to set appropriate stop-loss levels and manage risk more effectively.

- Comprehensive market perspective: By combining different time frames, day traders gain a broader understanding of market dynamics, including key price levels, trend structures, and potential areas of market reversal.

Swing Trading

Swing trading is the entering of trades for anywhere from a few hours to a few days or weeks. Here are some of the benefits of multiple time frame analysis for swing traders:

- Identifies longer-term trends for better trade selection.

- Enhances timing by aligning entry and exit points with higher time frame signals.

- Enables effective risk management by placing stop-loss levels based on a broader market context.

- Provides confirmation of trade signals across multiple time frames, boosting confidence in trade decisions.

- Optimizes trade performance and profitability by capturing larger price moves within the prevailing trend.

Long Term (Positional) Trading

Long-term trading seems like the least likely type to need multiple time frame analyses, but the opposite is true.

- Trend confirmation: Align trades with the long-term trend for higher success rates.

- Entry and exit timing: Fine-tune entry and exit points within the broader trend.

- Trade management: Monitor progress, assess trend strength, and make informed adjustments.

- Risk management: Evaluate overall risk and adjust position sizes accordingly.

- Market context: Gain a broader understanding of market dynamics and adapt strategies to changing conditions.

Conclusion: Multiple Time Frame Analysis Strategy

We hope this information helps you see the importance of doing this multiple-time frame analysis before considering a trade. Don’t forget to read about the multi-timeframe moving average strategy.

How do YOU view this analysis? Do you trade better with it? What advantages do you get while trading using MTF? What do you think about this simple way of trading forex?

So, maybe next time you check out your weather radar on your phone/computer, you will think about the different perspective from zooming out a little bit. Remember the importance of multiple time frame analysis.

Thanks for reading!

Please leave a comment below if you have any questions about trading multiple time frames!

Next Up

If you like this article, then you don’t want to miss the next one on the best swing trading strategy that works.

Multiple Time Frame Analysis Video

Multi Time Frame Analysis PDF

If you liked this article, grab our multiple time frame analysis PDF strategy here!

Multiple Time Frame Analysis Info-graphic Download

Please share this multi-time frame trading strategy below and keep it for your own personal use! Thanks, traders!

This is absolutely correct! My trading took a positive turn only after I stopped thinking the higher time frames are for the traders with big accounts. Though I have a small account, I start my analysis on much higher time frames so I can understand what is going on and then find the best entry on the smaller time frames. More pips are earned when you trade in the direction dictated by the bigger time frames.

That is correct David. Thanks for your comment and keep nailing those pips!

you are amazing…

???? Thank you!

Hi. Great article. Thank you! However, the link in the following line:

If you like this grab our strategy here!

Points to the wrong file. It goes to an RSI 80/20 ebook

Thank you for the heads up. We will look into that!

I want rsi